In this blog you learn how to increase the ROI of your investment portfolio as a Venture Capital firm. It is blog 3 in the serie of 3 on optimising your investment ROI.

An investment portfolio refers to an investor’s financial assets, including bonds, stocks, currencies, commodities, cash, and cash equivalents. It is a group of investments made to earn a profit while ensuring that capital or assets are preserved.

It is gratifying for businesses looking to invest in a project to have a loyal industry that gets bigger and better for years.

Return on investment is a quantifiable benefit expressed in a ratio that divides the net profit (or loss) from an investment by its cost. ROI helps you comprehend how much profit or loss your investment has made when you invest money in a business endeavor. The effectiveness or profitability of different investments can be compared as it is expressed as a percentage.

But how do you identify the actual performance of the individual companies within your portfolio to focus your efforts and decision-making better?

With the stock market swinging up and down sharply, you must monitor your investment plan and check your balances more frequently. You need to check if your combination of stocks, cash, bonds, and other investments is aligned with your goals, investment time horizon, financial situation, and risk tolerance for when the market declines.

Monitor whether your portfolio is at par to meet your goals and if it’s performing as well as comparable investments over a reasonable period. Consider modifying bonds, stocks, exchange-traded funds (ETFs), and mutual funds.

But instead of making scattered efforts to do so, here’s how we recommend approaching the same.

Streamline your investment portfolio ROI

While ever investor and investment firm has a few variables in focus to calculate the ROI, we recommend ensuring that the following get covered.

1. Establishing the right focus

Establish focus by implementing a proper conversion funnel per initiative and a reporting structure for your entire portfolio. As an investor, a proven conversion analysis is useful to help you understand how efficiently a company takes advantage of its leads.

However, many investment managers need a clearer picture of the performance of the various initiatives within their portfolio. Generally, they have a vague feeling of how the initiatives perform, sometimes represented by one or two vanity metrics such as likes and ad clicks.

It needs a precise reporting mechanism that compares the portfolio initiatives with individual initiatives against other significant initiatives in the same industry but outside the portfolio.

The proper focus can be established by identifying and focusing your efforts on the most promising initiatives in your investment portfolio.

Creating the right focus can be achieved in 3 simple steps:

On portfolio level:

Baseline assessment: We at Kanagawa have created Kanagawa’s Traction Tracker, which examines the performance of all initiatives within an investment portfolio based on their customer profile, value proposition, commercial strategy, growth plan, and operating model. It gives you a measurable metric to benchmark against a minimum readiness mark, over time, with other industries, etc. Apart from that, the Traction Tracker also identifies the gaps which need to be addressed to accelerate growth.

With the help of the Traction Tracker, you can measure and optimize the progress of your initiatives. This is a critical step that gives you a clear picture of the progress that’s being made. This further results in an appropriate reporting structure that enables the Investment Manager to make the right investment decisions.

Intervention and support of the right teams with the right marketing skills are mandatory to benefit the most based on the areas identified.

On the team level:

Baseline assessment: The Traction Tracker also helps to identify the most significant areas for improvement in an investment portfolio. For that, you need a perfect growth backlog that should be drafted with the most vital steps for validating your riskiest assumption.

You need a solid, dependable model that helps you grow strategically and achieve growth by leveraging the right marketing channels at the right moment. A growth model is one of the critical elements of the growth backlog and is generally represented as a conversion funnel. It is a process that makes your efforts toward growth quantifiable at every step of the marketing funnel.

It is important to frequently keep a tab on your results compared to your earlier predictions. You can update your predictions every few months to plan and determine where to put the money, which also helps you predict market movements.

However, you may only sometimes be right with your predictions. This is where the growth funnel comes in handy as it guides you on what part of the funnel you’ll need to focus more on when you notice discrepancies in your predictive analysis.

When you study your growth funnel and observe the metrics at each stage, you will be able to comprehend where the problem lies, and you can alter the existing approach and devise new strategies to find solutions. You will also be able to identify which part of the conversion funnel needs the most attention. As a result, you’ll be able to progress by focusing on the right metrics and ensuring that the entire team focuses on improving the same metric.

2. Recognizing the right skills

The world is rapidly transforming, and so are customer expectations. This transformation has heavily driven the initiatives to invest in digital and agile changes. But, to realize the total worth, the businesses and their teams should have the right skill sets and stay aligned, which is a key to competing in the modern economy.

To upkeep a portfolio’s positive performance, the investment manager needs to identify the team’s abilities and guide them by clarifying who is doing what and what is getting delivered when. With that vision, the managers can quickly determine the interdependencies and risks while prioritizing and allocating the work so that there are no undesirable impacts on the portfolio.

Identifying the right skills in the portfolio team is essential as they must ensure that their effort is strategically aligned to Investment Themes and executed with strategic objectives in mind.

Regardless of the investment approach, all portfolio managers must have specific ideation to be successful. An investment manager’s ability in an active process in having insights and investing is paramount since their investment style directly results in the fund’s returns.

However, it is noticed that in the early stages, i.e., exploration and problem-solution fit, the teams only consist of 2-3 members, which can be challenging as the process gets complex.

These members solely focus on developing the predicted solution and its features. When the core members feel the need to hire a marketer, they employ a Performance Marketer who focuses on the top-of-the-funnel metrics and their execution. The marketing teams need a clear direction regarding what they need to do, leading to a longer sales cycle time, little to no conversion, and wrong customer acquisition leading to low retention. With this kind of little to no success results, the teams tend to get demotivated.

Hence, your team must start early with proper marketing. As an investment manager, you can facilitate this process by implementing an appropriate system of reporting which contains all the relevant metrics, from awareness to retention, revenue, and referral.

How can you ensure that the teams use the same structured approach to growth, accelerating performance?

It is usually observed that businesses and their teams need to be better equipped with the right skill sets and processes to accelerate commercial growth.

Hence, it is incredibly crucial to establish a growth team with a sound marketing strategy and essential marketing skills early on in the initiative.

It is commonly seen that during the early stages of company growth, the team members take on multiple roles. Companies employ team members with specific skill sets for a particular position but are also expected to take on other challenges as they arise. However, it’s imperative to narrow down the team roles within your growth team:

Marketing Lead/ Head of Growth:

- Identify customer segments and related needs.

- Develop CVPs, pricing, and branding strategy

- Identify initial OKR and MVP

- Coach growth team on the conversion funnel, MVP, tactics, and tooling

- Run weekly growth meetings.

- Coach CEO and team on go-to-market strategy, including the creation of the initial storyline and finalization of the tactical plan

Product/ Tech Lead:

- Responsible for all tech-related things

- Define and develop core product elements

- Modify product elements required for experiments

- Define tech roadmap

Content Marketer:

- Define content strategy

- Create copy for blogs, emails, websites, whitepapers, etc.

- Manage distribution using adequate channels securing conversion and retention

UX/UI Designer:

- Create interaction models, user task flows, and UI specifications based on the initiative’s brand strategy and guidelines.

- Design prototypes, test usability, and build a website, landing page, app, etc.

Digital Experiment Lead

- Draft initial campaign strategy/ execution, CRO, analytics, and tooling

- Run experiments such as SEA and SEO.

- Create a dashboard, perform initial analysis and report experiment data

3. Implementing the growth marketing process

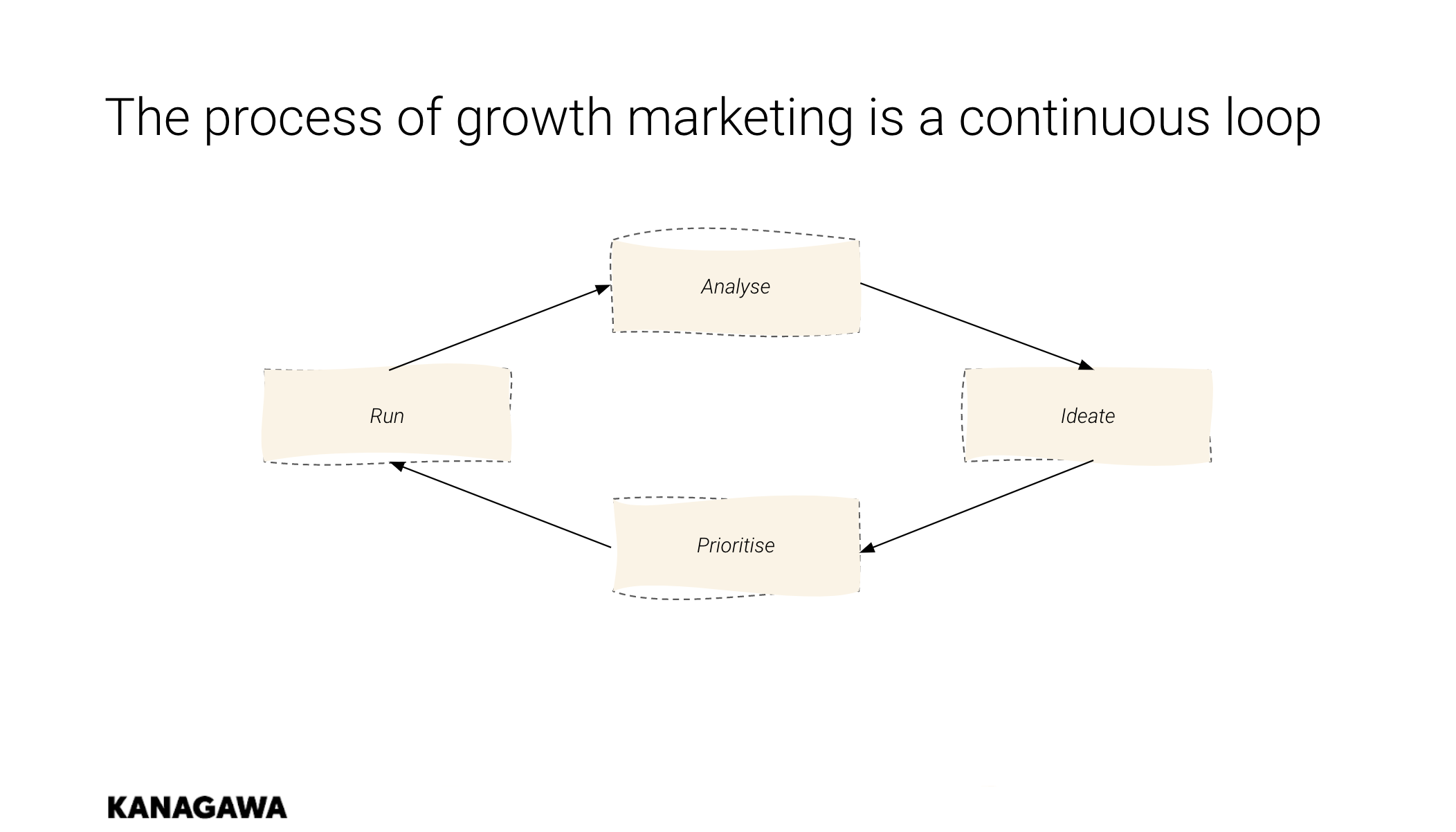

Growth marketing is a process of rapid experimentation across marketing channels. Implement a process of swift commercial validation, i.e., growth marketing, to initiate robust growth; you must build on the ones that work.

While conventional marketing emphasizes propositions through a linear process, growth marketing is about creating and applying swift user insights.

The initial goal of growth marketing is to validate your growth hypothesis, measuring how your future customers will find you and help you grow.

The process is to analyze the available data to draw the initial hypothesis you want to validate. Ideate a list of experiments you want to run to (in)validate your idea.

Using the Time, Impact, and Resources (TIR ranking) system, prioritize and assess the experiments you want to run first.

Running your experiments is the most crucial step of the process. The data collected is fed back to where you analyze the data from where you can optimize your experiments, (in)validate your hypothesis, and, in the end, accelerate growth! If your team can do this efficiently, they will be able to validate more experiments resulting in a competitive advantage.

Conclusion

Analyzing the performance of your portfolio companies is crucial to ensure you achieve maximum ROI from your investments. You must carefully assess the performance of individual companies before and guide them in the right direction to accelerate their growth.

Since 2018 we have been helping various VCs optimize their investment portfolio ROI.

Reach out to us if you are looking for advice on building a structured growth model to achieve product-market fit, thereby increasing the ROI of your investment portfolio.

PS: this is blog 3 in a serie of 3. The first is on how to optimise your the ROI of your innovation studio, aimed at corporate accelerators and can be found here.